Once upon a time there was Bill Schmick

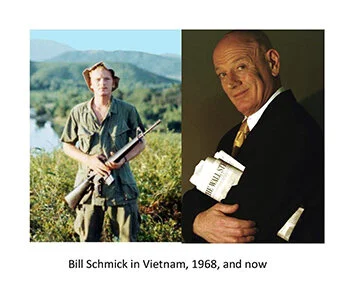

Bill Schmick was born in a blue-collar neighborhood of Philadelphia, just a few blocks north of “Rocky Balboa” territory where most of his Catholic schoolmates grew up to be either cops or criminals. He narrowly escaped both professions by volunteering to fight in Vietnam as a U.S. Marine at age eighteen, fresh out of high school in 1966.

“It was either that or working in a factory. Neither I nor my parents could afford to send me to college,” Schmick recalls. “I felt trapped, facing a dead end, and the Marine Corps was my only ticket out of that environment. I knew the risk but took it anyway.”

He spent two tours in Vietnam, won the Bronze Star and Purple Heart, as well as several more medals for bravery as part of the Combined Action Program (CAP). In CAP, young specially trained marines lived in remote villages, defending the Vietnamese farmers and teaching them ways to improve their crops, livestock, and health. The downside was CAP’s effectiveness. Its success so threatened the Viet Cong and North Vietnamese Army that all too often large enemy units would surround and destroy these 12-man teams.

“The casualty rate was about 50%,” Schmick says. “It was a different kind of war and nothing, absolutely nothing, influenced me more in my life. I learned what was important at a very young age, namely people: how to work and communicate with them, regardless of background or color.”

In 1970, he left the service and entered Temple University on the GI Bill. Within a year of college, he managed to talk his way into a job at what was then Philadelphia’s largest newspaper, The Evening and Sunday Bulletin. Six months later, he received his first journalism award as a reporter, followed by several front-page stories. Later, in 1973, he also won the William Randolph Hearst National Journalism Award. He graduated from Temple with a M.A. in Journalism in 1974 while working full-time as a reporter and columnist for the Bulletin. He then won one of the first Fulbright Fellowships to be awarded to a journalist in Japan.

“Japan was fascinating. I studied Asian psychology, received a brown belt in Aikido, and learned to play the Shakuhatchi, a flute often played by the Samurai, among other things,” he says. “By the end of a year and a half, I realized that I had just scratched the surface in understanding Asia, but it whetted my appetite to learn even more about foreign countries and people.”

He returned to the States in 1976, the Bicentennial year of the nation, and, disillusioned by the Watergate Affair, he turned his hand to politics. Hoping to make a difference, he organized a grassroots primary campaign for George Packard, a dark horse candidate pitted against two seasoned Republican politicians—the late John Heinz and Arlen Specter. The candidate and Bill walked across Pennsylvania, garnered a great deal of publicity and attention but finished last in the primaries. It was at that point, that Schmick moved to New York to work for Forbes Magazine as a reporter.

“I worked for Malcolm Forbes back then. He was some character—flying balloons, touring the world on a motorcycle—he inspired me to write well and later to go back to school and get a graduate degree.”

In 1979, Schmick was accepted to the MBA program at New York University and graduated in 1981. He left his mark on the school, organizing the student class to establish the NYU Entrepreneur Center which exists to this day as a multi-million-dollar program,

In 1981 he entered Wall Street working for Drexel Burnham Lambert as an institutional research salesman.

“In those days, Mike Milken was still sitting on the trading desk hawking junk bonds to a small audience,” Schmick remembers, “I learned the business at Drexel, servicing customers like Peter Lynch and George Noble of Fidelity and Sir John over at Templeton Investment Management. I joined at the bottom of the markets when no one was interested in stocks. I think the Dow was trading around 700 at the time.”

Within the year the markets came out of the doldrums and exploded to the upside. He soon had institutional clients of his own and was busy advising them on investments when Merrill Lynch approached him.

“Merrill had what was then this crazy idea that Americans would one day be interested in investing overseas. They were looking to establish that presence in the early Eighties and were interested in my foreign background. It was a meeting of the minds, plus they made me an offer I couldn’t refuse.”

That began an era of building foreign equity businesses for some of the most prestigious financial names on the Street. After Merrill, Schmick did the same thing at Prudential Bache Securities before joining Salomon Brothers at the end of the decade.

“Salomon was mainly a bond house back then and had gone through the “Lost Decade of the Eighties” in South America. Like many banks at the time, they had swapped debt for equity in places like Chile, Argentina, Brazil, and Venezuela. To me, emerging markets looked like they were ripe for American investments.”

So Schmick re-focused his attention from developing to emerging markets by the beginning of 1990. Once again, the trend was his friend. He was soon involved in weekly research trips up and down the South American continent braving kidnappers in Ipanema, drug lords in Bogota and the Shining Path in Lima. He brought back interesting company managements like Petrobras, Southern Peru Copper and Codelco, the Chilean copper conglomerate, to the offices of American Institutional investors like Janus, Fidelity, Capital Research and dozens more.

“I was never home. The entire decade of the Nineties was spent on planes, trains, and overland travel in Latin America, Eastern Europe, Russia, and Africa. By the year 2001, emerging markets were becoming legitimate investments and I felt it was time to return to my original focus, America.”

Schmick was sitting at his desk in mid-town Manhattan working for privately-held Arnhold & S. Bleichroder, a venerable investment boutique dating back to the Thirties, when the Trade Center was attacked. He admits he lost a lot of friends in the towers and has never looked at the Big Apple quite the same after that. However, while the airports were empty as businessmen and tourists feared for their lives, he was one of the first to board a plane and visit clients in Canada.

“It was a combination of things which led to my decision to move to the Berkshires permanently. I had been a resident of the Berkshires since 1987 and did the commuter, weekender thing between an apartment in Manhattan and my home in the country. I wanted to get off the merry-go-round: stop commuting, stop all the business travelling. At the same time my company was bought out by a French bank. It was an ideal time to make the leap and my wife wanted it as well.”

In 2003 Bill, with his wife, Barbara, made it permanent.

“We love the Berkshires,” says Barbara Schmick. “We actually got married on the top of Catamount Ski slope in 2000. We were both ski and snowboard instructors on the weekends there and figured we could ski right past our wedding spot every winter season.”

For the next three years, Bill accomplished his life-time goal of writing a novel. “I spent seven days a week on that opus and the manuscript still needs work, but my editor says it has real promise. By the time I finished the second draft however, I was ready to get back into the markets.”

Neither Barbara nor Bill wanted to return to Manhattan. So, he inquired about job opportunities in the area. It took less than three weeks before Bill had his choice of offers and went to work at Dion Money Management in Williamstown, MA. He worked with over 500 high net worth clients worldwide, created portfolios and worked during his spare time to acquire a certificate in financial planning. It was clear to him that a money manager today needs to know more than how to make clients money.

“Most clients expect their advisor to give them advice on their entire financial life whether it is in estate planning, insurance, heath care or tax planning so I needed to know more about those areas.”

As 2007 began to wind down and stock markets worldwide seemingly set new records on a daily basis, Bill’s concern continued to mount.

“Back in 2006, I started to pay down all our debt and hunker down. Barbara though I was crazy at the time because the markets were roaring higher and everything seemed well with the world.”

Yet Bill had seen this progression before in many, many markets over his lifetime. He recognized it for what it was.

“The markets were approaching a peak. I’ve seen it before and as stocks became overextended, the economy overheated, the housing market had all the indications of a massive bubble. It was time to cash in.”

Fortunately for many readers in the Berkshires, Bill began to write about his misgivings in several investment and financial columns in late 2007. Throughout 2008 he continued to sound the warning and only became positive once the markets declined to his forecasted bottom—680 on the S&P 500 Index.

“I took a lot of grief from my company and from readers who deeply disagreed with my bearishness. But that’s okay, I’m opinionated and a contrarian, but I have a thick skin. If it turned out I was wrong, then I would apologize. It wouldn’t be the first time and certainly won’t be the last.”

But Bill wasn’t wrong and as a result his columns grew in popularity and now boast a wide readership throughout the region.

He now writes regularly for various publications such as The Berkshire Eagle, iBerkshires.com, and various other publications throughout the nation. He had also expanded into radio and television, providing market analysis and financial advice.

In June 2009, Bill joined Allen Harris at Berkshire Money Management in Pittsfield, MA. as a portfolio manager. His main focus was attracting new clients from within the Berkshire region and managing their investment with the firm’s unique, ‘hands-on’ style of money management.

Over the last ten-plus years, Bill watched the economy of the Berkshires blossom, while an influx of retirees from Boston and Manhattan kept him busy. As his client base grew older and began to retire, their needs changed. Retirement and estate planning became far more important. Social Security and Medicare questions needed to be answered. Advising clients on how to take care of aging parents and contributing funds for the grandchildren’s educational needs took center stage. Gradually, more and more of his day-to-day interface with clients became retirement-centric.

As social media continues to replace more traditional sources of communication such as newspaper, Bill now provides digital services through Facebook, LinkedIn and other internet sites to complement his writings.

In the meantime, Bill has officially decided to take his own advice and “change careers,” as he puts it. Although he will still be giving investment advice, Schmick’s Retired Investor is his newest venture. He hopes his new blog will be a “go to” source of retirement information and podcasts for those who are following his lead into semi-retirement.